The side-hustle economy worldwide reached $556.7 billion in the year 2024, with a compound annual growth rate of 16.18% estimated to push it to $2.15 trillion by 2033, per industry market research.

More than half of American side hustlers have started making side income within the past two years, with 77% of Gen Z and 52% of millennials launching side hustles in recent times. This clearly highlights a generational movement towards financial independence. If you too are considering building passive income, this is a great time to start. And here are some great passive income ideas you can explore to start your journey.

What is Passive Income?

Passive income meaning means money earned from little active effort after an initial investment of time, money, or resources. This income continues with no daily active participation needed, which distinguishes it from traditional employment, where income stops when work stops.

The initial setup needs significant work, mainly researching investments, preparing products, or establishing systems. But once operational, these income streams require considerably less attention. Do note, passive income isn’t effortless or instant. However, the key difference is scalability. Passive money can grow without equal increases in your time or effort. With passive income, you’ve more financial freedom that traditional jobs can’t provide.

Comparison Table: Passive Income Ideas, Earnings, and Platforms

|

Passive Income Idea |

Earning | Platforms for Passive Income in the USA |

| Dividend-Paying Stocks | $1000-$10,000+ (varies with investment) |

Vanguard, Fidelity, Charles Schwab |

|

Rental Properties |

$16000- $87000+ | Zillow, Apartments.com, Airbnb, Vrbo |

| REITs | 5% to 10% annual returns |

Fidelity, Vanguard, TD Ameritrade |

|

Real Estate Crowdfunding |

7% to 12% annual returns | Fundrise, Arrived, Groundfloor, RealtyMogul |

| P2P Lending | 10% to 18% annual returns |

Prosper, LendingClub, Upstart |

|

High-Yield Savings/CDs |

4.5% to 5.25% APY | Marcus, Ally Bank, American Express Savings |

| Treasure/Corporate Bonds | 4% to 5% annual yield |

TreasuryDirect.gov, Fidelity, Vanguard |

|

Online Courses |

$1000- $100,000+ | Teachable, Skillshare, Coursera |

| Affiliate Marketing | $600-$120,000+ |

Amazon Associates, ShareASale, CJ Affiliate |

|

Digital Items |

$500-$50,000+ | Gumroad, Etsy, Amazon KDP, Shopify |

| Blog/Niche Website | $500-$30,000+/per month |

WordPress.org, Mediavine, Google AdSense |

|

YouTube Channel |

$1000-$100,000+ per month | YouTube Partner Program, Patreon |

| Index Funds or ETFs | 8% to 10% average annual return |

Vanguard, Fidelity, Schwab, BlackRock |

| Storage or Parking Rental | $1200-$4800 per annum |

Neighbor, Spacer, StoreAtMyHouse, ParkWhiz |

Top 15 Passive Income Ideas in the USA

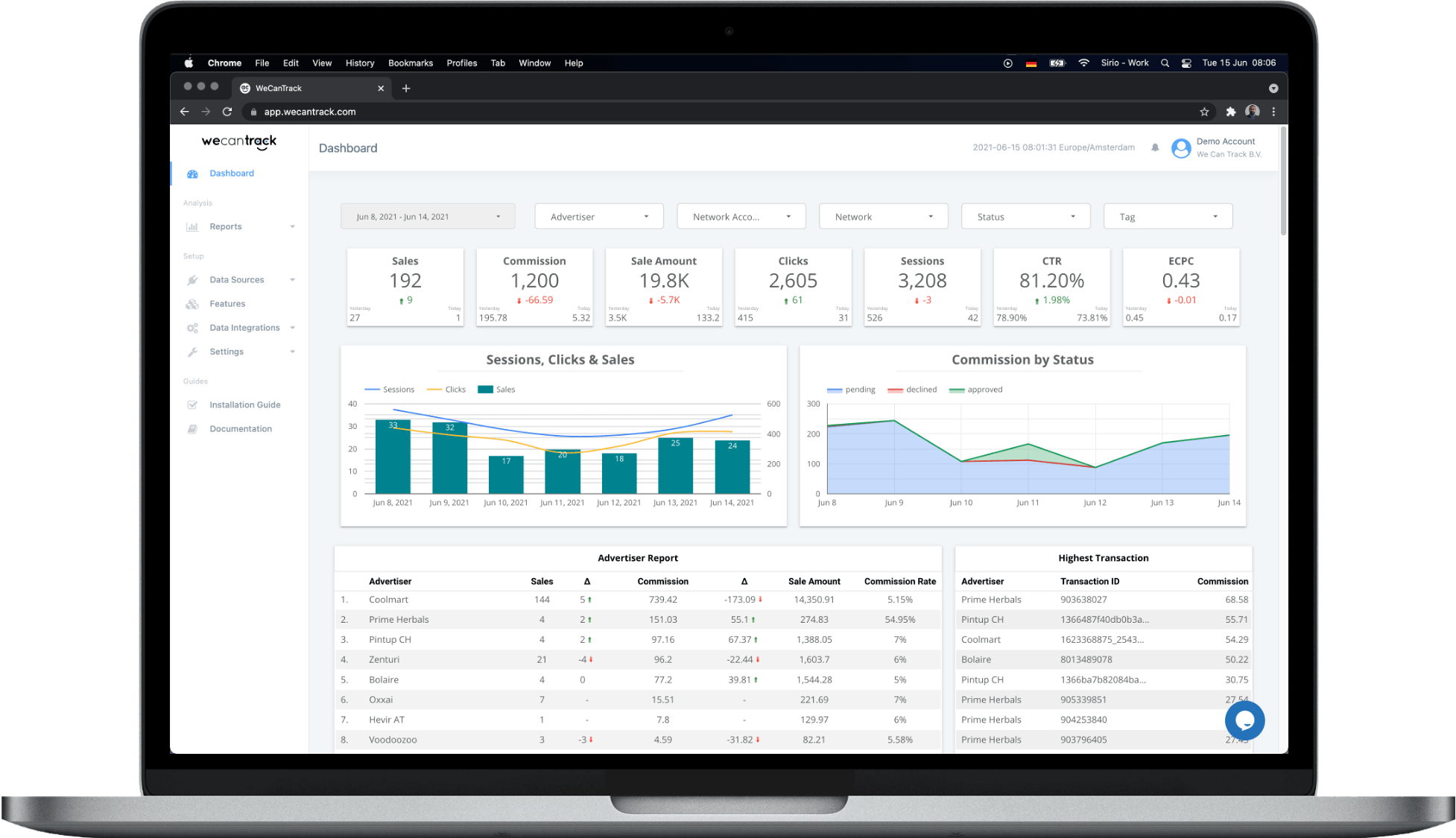

1. Affiliate Marketing

Promoting products or services and getting commissions on resulting sales can help you get passive income with comparatively low upfront effort. In this passive income idea, you recommend items people already need or love, and when someone buys using your link, you earn. Over time, with persistent content and a smart promotion strategy, affiliate marketing becomes a simple way to make passive income.

Income Potential

Earnings from affiliate marketing range from $50-$10,000+/month, based on traffic, niche, and commission rate.

Pros

- No product creation or inventory needed

- Low start-up costs

- Multiple program options across different industries

- Scalable with content growth

Cons

- Needs existing audience or traffic

- Commission rate variations

- Link tracking and management are needed

Tips to Succeed

- Prepare content around product reviews and comparisons

- Be focused on high-commission niches

- Disclose affiliate relationships transparently

Platforms in the USA

- Amazon Associates

- ShareASale

- ClickBank

- CJ Affiliate

- Rakuten Advertising

Risks Involves

- Program terms vary or end

- Algorithm updates affecting traffic

- Audience trust is damaged by over-promotion

- Reliance on third-party platforms

Also Read: Top 10 Affiliate Programs in the U.S.

2. Dividend-Paying Stocks

Dividend stocks mean buying shares of companies who pay out a portion of their profits to shareholders, usually every quarter. This is an effective way to earn passive income and make side money with no need to work actively for it.

Income potential

At present, the S&P (The Standard and Poor’s) 500 dividend yield is below 1.3%, and therefore, investors would have to invest more than $700,000 to earn $10,000 every year. However, dividend aristocrats (companies like Coca-Cola and McDonald’s that have raised dividends for nearly 25 consecutive years) might offer promising returns.

Pros

- Established, reliable income stream

- Low maintenance once the portfolio is established

- Potential for capital appreciation

- Putting your money into different companies, not just one

Cons

- Demands substantial initial capital

- Market volatility affects stock prices

- Dividend cuts possible during downturns

- Tax implications on dividend income

Tips to succeed

- Be sure to focus on companies with a consistent dividend growth history

- Diversify across sectors to reduce potential risk

- Reinvest dividends to compound returns

- Before investing, check about company’s financial health

Platforms to apply in the USA

- Fidelity

- Vanguard

- Charles Schwab

- Robinhood

- E*TRADE

Risk Involves

- Market downturns may reduce both stock value and dividend payments

- Company financial troubles may lead to dividend suspensions

- Changes in interest rates affect stock performance

3. YouTube Channel

YouTube is a great platform for building passive income for those who like to travel, sing, do DIY stuff, or something they can show off. There’s a saying among social media content creators that ‘there is an audience for every type of content.’ YouTube works best for creative people in creating a passive income by doing what they like.

Income Potential

After getting monetization on, most YouTubers start earning thousands of dollars for the number of views they get.

Pros

- Perfect for side income

- Exposure, popularity,

- Great for personal brand building

- Evergreen content earns indefinitely

Cons

- Need video production skills

- Time-intensive for quality content creation

- Algorithm changes affect visibility

- Monetization threshold requirements

Tips to Succeed

- Start with evergreen content like tutorials and educational content

- Optimize titles, thumbnails, and observe what works best

- Engage with the audience in comments

- Diversify income through sponsors, affiliates, and the Patreon Platform

Platforms in the USA

- YouTube Partner Program

- Patreon (for fan support)

- Channel memberships

- Affiliate marketing

Risks Involves

- Demonetization for policy violations

- Algorithm changes are reducing views

- Platform competition

- Copyright strikes

Also Read: How to Make Money on YouTube 2025 – Top 10 Strategies

4. Rental Properties

One way people learn how to make passive income and make extra money is through real estate. As the idea name implies, buy a place and rent it out. Every month, the rent comes in, and by time, the property itself can become valuable. It’s a slow-and-steady approach, but it honestly works for a lot of folks.

Income Potential

In 2024, on average, the landlord reported earning over $16,000 from leased property. However, landlords in the U.S. reported an average yearly income of $87,280 in 2025, with actual income varying broadly with property and location.

Pros

- Tangible asset with appreciation potential

- Tax benefits, i.e., depreciation deductions

- An inflation hedge, as rents generally increase

- Leverage opportunities via mortgages

Cons

- High upfront capital is needed

- Property maintenance responsibilities

- Tenant management challenges

- Market-dependent returns

Tips to Succeed

- Research local rental markets properly

- Consider hiring a property management company

- Maintain an emergency fund for repairs

- Screen tenants carefully to minimize problems

Platforms in the USA

- Zillow Rental Manager

- Apartments.com

- Airbnb for short-term rentals

- Vrbo

Risks Involves

- Lengthier vacancy periods without rental income

- Property damage from tenants

- Market downturns affecting property values

- Legal liabilities as a property owner

5. Prepare and Sell Digital Courses

Offering educational content through online learning sites can create a steady stream of recurring revenue. When your course is published, students can keep enrolling and learning from it long after you’ve done the work, becoming one of the best passive income streams for creators. Be it skill-based, lessons, tutorials, or niche expertise, online courses are among the best passive income ideas for someone who enjoys teaching and wishes to earn long-term.

Income Potential

The best online courses generate hundreds of thousands to millions of dollars for their creators.

Pros

- One-time creation, unlimited sales

- Scalable income potential

- Establishes expertise and authority

Cons

- Significant upfront time investment

- Needs marketing efforts

- High competition in popular topics

Tips to Succeed

- Choose topics matching your expertise

- Invest in quality production

- Research the market demand before creating

- Update content actively in order to maintain relevance

Platforms in the USA

- Teachable

- Skillshare

- Thinkific

- Coursera

Risks Involves

- Content becoming outdated

- Market saturation in the topic area

- Initial investment without guaranteed returns

6. REITs or Real Estate Investment Trusts

REITs are publicly traded companies who own and manage income-producing properties. They give investors access to real estate returns without owning or managing property. As one of the top passive income ideas for 2025, REITs provide a great way to earn steady dividend income while diversifying your portfolio.

Income Potential

Real Estate Investment Trusts are required to distribute a minimum of 90% of their income to shareholders.

Pros

- No property management responsibilities

- High liquidity via stock market trading

- Diversification across several properties

- Professional management

Cons

- REITs can swing far beyond the overall stock market, particularly in downturns.

- No direct control over investments

- Market volatility exposure

- Tax treatment differs from qualified dividends

Tips to Succeed

- Diversify across different REIT types, which include residential, commercial, and industrial.

- Research management teams and track records

- Prefer REIT ETFs for huge diversification

- Assess occupancy rates and lease terms

Platforms in the USA

- Vanguard

- Fidelity

- TD Ameritrade

- Interactive Brokers

Risks Involves

- Interest rate sensitivity affects REIT performance

- Economic downturns have a great impact on property values and rental income

- Sector-specific risks, such as retail struggles, office space changes, etc.

7. Create and Sell Digital Items

Preparing ebooks, templates, graphics, or software that can be sold over again and again with no need to manage inventory is one of the great passive income ideas for digital creators. You create once, market it, and keep earning every time someone downloads or purchases your product.

Income Potential

Variable depending upon product type and marketing, ranging from hundreds to thousands every month

Pros

- No inventory or shipping costs

- One-time creation effort

- Unlimited scalability

- High profit margins

Cons

- Needs specific skills or expertise

- Marketing is necessary for sales

- Initial time investment

- Potential for piracy or unauthorized sharing

Tips to Succeed

- Solve specific problems for the target audience

- Build an email list for promotion

- Prepare professional-level products

- Use multiple sales platforms

Platforms in the USA

- Etsy for templates and graphics

- Gumroad

- Shopify

- Creative Market

- Amazon Kindle Direct Publishing

Risks Involves

- Market saturation in renowned niches

- Product obsolescence

- Platform fee varies

8. Real Estate Crowdfunding

Most popular real estate crowdfunding platforms, such as Arrive, Fundrise, and Groundfloor, let you invest with others in large residential or commercial projects. Instead, you own a whole property by yourself, you contribute what you can, and earn a share of the returns. This is a simple yet effective way to generate passive income with no need to manage real estate on your own.

Income Potential

Platforms usually target returns between 7% and 12%, with many offering regular distributions.

Pros

- Low minimum investments – as low as $100

- No property management duties

- Diversification across several projects

- Access to commercial real estate options

Cons

- Limited liquidity compared to stocks

- Platform fees reduce returns

- Project-specific risks

- Some platforms need an accredited investor status

Tips to Succeed

- Begin with a platform accepting non-accredited investors

- Review platform track records carefully

- Understand holding timelines before doing investments

Platforms in the USA

- Fundrise

- Groundfloor

- Arrived Homes

- CrowdStreet

- Realty Mogul

Risks Involves

- Project delays or failures

- Platform bankruptcy

- Illiquidity during holding periods

- Market downturns affecting property rates

9. Run a Blog or Niche Website

Setting up content-rich sites and monetizing them via ads, affiliate links, and sponsored content can be a passive income generators. Once your website gets stable traffic, it offers consistent earnings even if you’re not actively working on it.

Income Potential

Well-established blog websites can make upward of $30,000 every month

Pros

- Low set-up costs

- Builds long-term assets

- Multiple monetization methods

- Location-independent work

Cons

- Takes months or years to build traffic

- Algorithm dependency

- SEO knowledge is a must

- Needs consistent content creation

Tips to Succeed

- Select profitable niches with search demand

- Focus on SEO-optimized content

- Build an email list other than blog growth

Platforms in the USA

- WordPress.org

- Mediavine – ad network, needs 50k sessions

- Google AdSense

- Ezoic

- Shopify (for affiliate products)

Risks Involves

- Google algorithm updates affecting traffic

- Time investment with no guaranteed returns

- Hosting and domain costs

- Platform policy differs

10. Peer-to-Peer (P2P) Lending

P2P lending platforms connect individual lenders and borrowers, and investors get interest on the loans they fund. It’s a hand-off way to earn extra money wherein you’re allowed choosing who you want to lend to, set your investment amount, and collect repayments with time. Although the returns can be lucrative, it is also important to understand diversification and risk.

Income Potential

Well-known P2P sites like LenderMarket offer annual returns ranging from 10% to 18%, which is way ahead of a traditional savings account.

Pros

- Higher returns, unlike traditional savings

- Diversification across several loans

- Choice of risk levels

- Passive income through interest payments

Cons

- Unlike traditional loans at 2.78%, P2P loans show 17.3% average default rate

- High fees, with yearly servicing fees of 1% of the outstanding loan balance

- Limited regulatory protection

- Economic downturns increase defaults

Tips to Succeed

- Start with low-risk loan grades

- Reinvest returns for compounding

- Monitor the platform’s financial health

Platforms in the USA

- Prosper

- LendingClub

- Upstart

- Peerform

Risks Involves

- Borrower defaults leading to principal loss

- Platform operational failures

- Economic recession is increasing default rates

- No FDIC insurance protection

11. Renting Storage Space or Parking Areas

Monetizing unused space in your home, garage, or driveway is one of the good ideas for passive income. Whether you put spare room on rent, list driveway parking, or provide storage space, it’s a simple method to turn not used square footage into steady monthly earnings with less effort.

Income Potential

The average host makes around $200/month for renting out their driveway.

Pros

- Uses otherwise unused space

- Low startup costs

- Flexible rental terms

Cons

- Limited income potential

- Property wear & tear

- Market-dependent demand

- Liability concerns

Tips to Succeed

- Price is relatively based on location

- Maintain clean, secure spaces

- Provide clear access instructions

Platforms in the USA

- Spacer for parking

- StoreAtMyHouse

- JustPark

- ParkWhiz

Risks Involves

- Liability for accidents

- Property damage from renters

- Insurance coverage gaps

- Zoning or HOA limitations

12. Index Funds and ETFs

Exchange-traded funds (ETFs) and index funds have worked for many who wanted to make a passive income without dedicating too much energy or effort. These are the cost-effective routes to participate in the stock market, and you do not need to constantly manage these. These funds mirror the performance of popular market indices, which allow investors to own a diverse basket of companies in a simple investment.

Income Potential

In 2024 alone, second income opportunities like this outperformed two-thirds of their active counterparts, and over the past two decades, nearly 90% of active managers have failed to beat low-cost benchmarks

Pros

- Low fees and maintenance

- Broad market diversification

- Historically strong returns

- Minimal research required

Cons

- No downside protection in crashes

- Returns match the market, don’t exceed it

- Short-term volatility

- Capital gains tax considerations

Tips to Succeed

- Always choose low-expense ratio funds for safer investment

- Invest for the long term to see major outcomes

- Make sure to rebalance the portfolio annually

Platforms in the USA

- Vanguard

- Fidelity

- Charles Schwab

- BlackRock (iShares)

- State Street (SPDR)

Risks Involves

- Market downturns affect portfolio value

- Lack of active management during crises

- Sector concentration in some indices

14. High-Yield Savings Accounts and CDs

Traditional savings vehicles offering interest on deposited funds with FDIC protection are one of the safest ways to make passive income. While high-yield savings accounts and CDs don’t promise high returns, they provide great peace of mind, stable interest, and zero stress. Best for anyone who wants guaranteed growth with no market risk included.

Income Potential

Top accounts and CDs, in 2025, provide 4.5% – 5.25% APY, ensuring risk-free returns.

Pros

- FDIC insured up to $250,000

- No risk to principal

- Easy setup and management

- Liquidity with savings accounts

Cons

- Lower returns compared to other investments

- CDs lock fund for fixed terms

- Interest rate fluctuations

- Inflation may erode purchasing power

Tips to Succeed

- Shop around for higher rates

- Consider LD laddering for liquidity

- Use for emergency funds

- Track rate changes and switch when it seems beneficial

Platforms in the USA

- Ally Bank

- Marcus by Goldman Sachs

- CIT Bank

- Synchrony Bank

- American Express Personal Savings

Risks Involves

- Opportunity cost of higher-yielding investments

- Easy withdrawal penalties on CDs

15. Treasure Bonds and Corporate Bonds

Government and corporate debt securities pay regular interest, making them a smart way to grow your wealth without much effort needed. They let you lend funds to institutions in exchange for stable interest payments. If you’re exploring how to make side money, earn passive income, and build long-term financial stability with minimal risk added, Treasure Bonds and Corporate Bonds are perfect for you.

Income Potential

U.S. treasury bonds and high-level corporate bonds now ensure yields between 4 percent and 5 percent – $400 to $500/year for every $10,000 invested.

Pros

- Minimal risk, particularly with Treasury Bonds

- Treasury income isn’t taxed at the state level

- Predictable income source

- Portfolio stabilization

Cons

- Interest rate risk affects bond values

- Inflation can erode actual returns

- Long holding durations for best returns

Tips to Succeed

- Establish a bond ladder for regular income

- Consider bond ETFs for diversification

- Match bond maturity to income needs

Platforms in the USA

- TreasuryDirect.gov – for treasury bonds

- Vanguard

- Fidelity

- Schwab

- TD Ameritrade

Risks Involves

- Increased interest rates reduce bond values

- Corporate bond default risk

- Inflation eroding purchasing power

Conclusion

Building passive income needs initial effort, be it through capital investment, skill development, or time commitment. The fifteen-idea outline provides diverse options across risk levels, capital requirements, and involvement needs. Consider starting with one or two approaches that best match your comfort level. Next, expand as you gain experience and confidence. The thing is, taking action now to build income streams that will support your financial future for the coming years.

Add Comment